Support Us

The Department of Art and Art History is dedicated to fostering the creative talents and projects of its students and faculty members.

We offer many ways that you can get involved and support the department.

Establish a student scholarship endowment that will support students today and in the future.

Give to the department’s annual giving fund, which allows us to pay for student travel and faculty research.

Fund The Mesoamerica Center and support the study of Maya culture by faculty and students.

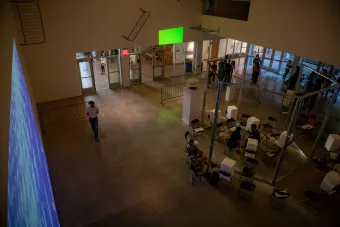

Support Visual Arts Center exhibitions and programming and provide students with opportunities to work with up-and-coming contemporary artists.

Ways to Give

Online

You can make a gift or future pledge to the Department of Art and Art History on the university’s online giving page.

Contact Us Directly

For more information about how you can support the Department of Art and Art History, please contact:

College of Fine Arts Development

cofadevelopment@austin.utexas.edu

512/ 471-6468

Gift and Estate Planning

Planned gifts can be made now or deferred to a later time. Such gifts include bequests through a will, retirement plan assets, and charitable trusts.

Endowments

When you create an endowment, you create a legacy at the Department of Art and Art History. The money is invested, and each year a distribution is made from the endowment to support the program or area of your choice.

Matching Gifts

You may be able to double your gift to the department if your employer sponsors a matching gift program.

Payroll Deduction

If you’re a UT employee, you can give to the department through payroll deduction.